What Is a Conventional Mortgage or Loan?

A traditional mortgage is a loan that a buyer obtains from a private lender. Generally speaking, a conventional loan requires a better credit score to get approved than one from the Federal Housing Administration (FHA).1.

Conventional loans are not provided by or guaranteed by a government body. These mortgages are instead provided by private lenders such as banks, credit unions, and mortgage companies.

However, the two government-sponsored organizations (GSEs) that are able to guarantee certain conventional mortgages are the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corp. (Freddie Mac).

An Example of a Traditional Mortgage

This can be a cheap option to borrow money to purchase real estate if you can meet the rather stringent conditions to be eligible for a traditional mortgage.

For instance, you could be able to obtain a conventional mortgage with a locked-in rate of 5.50% if you took out a mortgage to purchase a $500,000 property, had a $100,000 down payment (that’s 20%), and had good credit (650). This means that simply the principle and interest payments on a 30-year loan would need a monthly payment of almost $2,271.

Conventional Mortgages versus FHA Loans

The main distinction between FHA and conventional mortgages is that the former are intended to facilitate homeownership for low- to moderate-income borrowers who might not otherwise be able to obtain financing due to a lack of savings or a bad credit history.

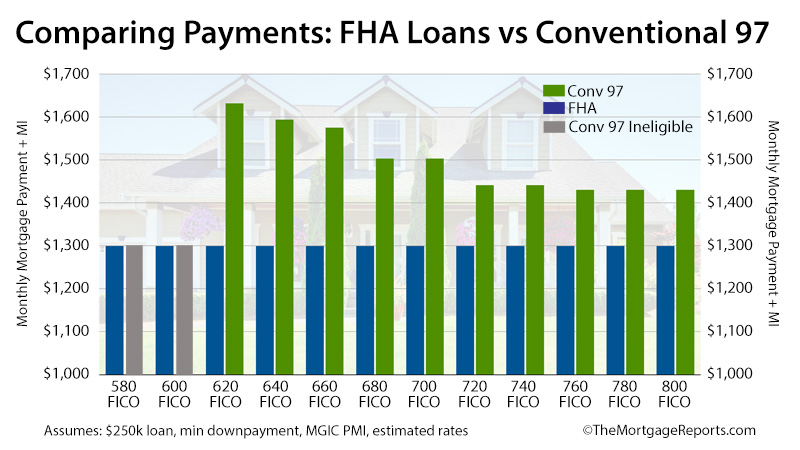

The down payment required for an FHA loan is less for those who qualify. Additionally, compared to other mortgage loans, the credit standards are far less stringent; people with credit scores as low as 580 may be approved for financing. The FHA does not award these loans directly. Rather, FHA-approved lenders advance them.

On the other hand, applicants for a traditional loan usually need to have excellent credit ratings of at least 620 and flawless credit reports free of major errors. Interest rates on conventional loans are influenced by the down payment amount, the mortgage type that the borrower chooses, and the state of the market.

Conventional versus Adhering

Erroneously, conforming mortgages or loans are frequently used to refer to conventional loans. The two are separate categories even though there is some overlap.

A conforming mortgage is one whose fundamental terms and circumstances satisfy Freddie Mac and Fannie Mae’s funding requirements. The Federal Housing Finance Agency’s annual dollar cap is the most important of them (FHFA). A loan cannot be more than $766,550 in the majority of the continental United States in 2024 (up from $726,200 in 2023).7.

Therefore, not all conventional loans are conforming, even though all conforming loans are conventional. For instance, a $800,000 jumbo mortgage qualifies as a conventional mortgage but not a conforming mortgage since it exceeds the threshold for Fannie Mae or Freddie Mac backing.

There were 7.5 million homeowners with FHA-insured mortgages at the end of the 2023 fiscal year.8 Conventional mortgages have a very sizable and liquid secondary market. The majority of traditional mortgages are bundled into pass-through mortgage-backed securities (MBS), which are traded on the mortgage to be announced (TBA) market, a reputable forward market. Collateralized mortgage obligations (CMOs) are created by further securitizing a large number of these traditional pass-through instruments.

Conventional Mortgage Types

Conventional mortgages come in a variety of forms, and the terminology used to describe them can be imprecise. These are the most typical kinds.

Conforming Conventional Loans:

As previously indicated, they are loans that meet the requirements established by Freddie Mac and Fannie Mae.

Jumbo loans: Jumbo loans let you borrow more money than what conforming loans will enable you to borrow up to. But usually, they demand a bigger down payment, a lower debt-to-income (DTI) ratio, and a higher credit score.

Loans classified as “portfolios” are conventional loans that a lender choose to hold in-house rather than put up for sale on the secondary market.

Subprime loans: Conforming loans demand a minimum credit score of 620 and a debt-to-income ratio (DTI) of less than 50%. However, you can be eligible for a subprime mortgage loan if your credit isn’t quite there.

Conventional loans with amortization: These loans have full amortization, thus from the start of the loan repayment period until the conclusion, homebuyers will get a fixed monthly payment.

Loans with adjustable rates: An adjustable-rate mortgage offers a fixed interest rate for a predetermined amount of time, usually three to ten years. Your interest rate may then change annually after that.

Documentation Needed for a Traditional Mortgage

Lenders have tightened loan standards in the years following the subprime mortgage crisis of 2007, but most fundamental conditions have remained the same.9. After completing an official mortgage application and typically paying an application fee, prospective borrowers must provide the lender with the required paperwork so that the lender can run a thorough background check, credit history check, and credit score assessment.

There is never a fully financed property. A lender will examine your assets and obligations in addition to your ability to make your monthly mortgage payments, which typically shouldn’t be more than 35 percent of your gross income.10 In addition, the lender will want to know how much you can afford for a down payment on the house as well as other upfront expenses like broker fees, settlement or closing costs, and loan origination or underwriting fees, all of which can dramatically increase the cost of a mortgage. Among the necessities are:

1. Evidence of Income

These records will consist of, but may not be restricted to:

thirty days’ worth of pay stubs displaying earnings for the entire year

Federal tax returns for two years

A statement of all asset accounts, such as your checking, savings, and any investment accounts, should be sent every sixty days or every quarter.

W-2 declarations for two years

Additionally, borrowers must be ready to provide documentation of any additional income, such as bonuses or alimony.

2. Resources

To demonstrate that you have the money for the down payment, closing expenses, and cash reserves for the home, you will need to provide bank and investment account statements. You will need gift letters, which attest that the funds you receive from friends or family to help with the down payment are not loans and have no mandatory repayment terms.

3. Verification of Employment

These days, lenders want to guarantee that they are only making loans to borrowers who have steady incomes. Your pay stubs will be requested by your lender. Borrowers who work for themselves will have to submit a lot more documentation about their revenue and business.

4. Additional Records

To obtain your credit report, your lender will require a copy of your driver’s license or state ID card, as well as your signature, Social Security number, and other information.

Interest Rates for Conventional Mortgages

Conventional loans may have higher interest rates than government-backed mortgages, like FHA loans (although these loans, which usually have mortgage insurance premiums paid by borrowers, may become similarly costly over time).

The interest rate on a conventional mortgage is influenced by several factors, including the loan’s terms (length, amount, and fixed or adjustable interest rate), as well as the status of the financial and economic markets at the moment. Mortgage lenders set interest rates based on supply and demand for mortgage-backed securities as well as on estimates of future inflation. A mortgage calculator can show you how different rates will affect your monthly payment.

Who May Qualify

Those in solid financial standing with established credit and great credit reports can frequently apply for conventional mortgages. To be more specific, the ideal candidate should have:

A respectable credit score or higher.

A person’s credit score is a numerical representation of their ability to pay back a loan. Credit scores are influenced by the borrower’s credit history and the quantity of late payments. A credit score of at least 620, if not higher, might be required for admission. Furthermore, the best terms are only available to those who have an outstanding credit score; the lower the interest rate on the loan, the higher the score.Thirteen a sensible debt-to-income (DTI) ratio. This is the entire amount that you will be paying each month for your loan, including.

Desi Serial

Desi Serial